Paytm's Turbulence

Navigating Regulatory Storms and Fintech Fallout

The Latest Scoop

Paytm Payments Bank Ltd. (PPBL) has been directed by the central bank to cease the majority of its operations, which include accepting new deposits, executing credit transactions, and topping up customer accounts, prepaid devices, wallets, and toll-paying cards, after February 29. Customers can use the funds in their wallets to pay for services and access their existing deposits through February 29. And if the RBI does not relent, top-ups for the Paytm wallet will stop, and transactions through it can no longer be carried out.

Frontline Focus: Confronting Major Issues

In 2021, the Reserve Bank of India (RBI) detected serious KYC (Know Your Customer) Anti-Money Laundering violations in a bank and directed it to address these deficiencies. (PPBL) had lakhs of non-KYC-compliant accounts, and in thousands of cases, a single PAN was used for opening multiple accounts. There were instances where the total value of transactions ran into crores of rupees, much beyond regulatory limits for minimum KYC pre-paid instruments, raising money laundering concerns.

Accordingly, in March 2022, the RBI imposed supervisory restrictions on PPBL to stop onboarding new customers with immediate effect and to appoint an external audit firm to conduct a comprehensive system audit.

Consequences Collide: Unravelling the Aftermath

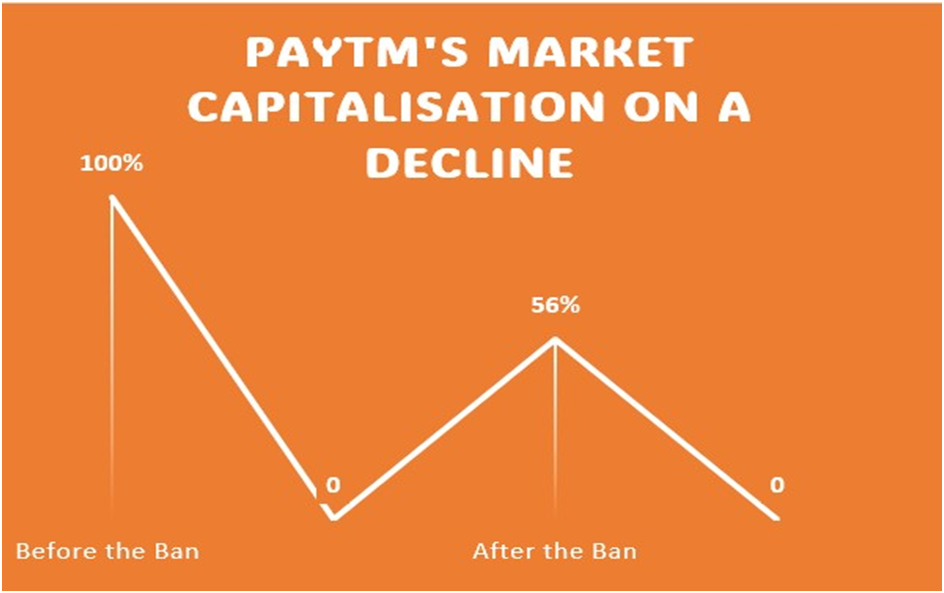

One97 Communications Ltd., the parent company of the platform Paytm, has suffered a major setback in only two days. This order from the Reserve Bank of India (RBI) has resulted in the company's shares tumbling by 40%. On Friday, the company's shares plunged by 20% to Rs 487.05, hitting its lowest trading permissible limit for the day on the Bombay Stock Exchange (BSE). This has resulted in the company's market capitalization eroding by a staggering Rs 30,931.59 crore to Rs 17,378.41 crore in just two days.

The RBI's move has come as a major blow to Paytm, which has been expanding its business by offering banking and financial services to its users. The company had recently launched its credit card offering, which was aimed at providing users with a convenient and affordable way to access credit. As the company continues to encounter challenges, people may seek alternatives in the digital payment space, yet the debate over loosening regulations in the fintech space remains a headline question.

What do the netizens say?

A few days following the RBI's notice, BharatPe founder Ashneer Grover took on X and said that actions of this nature could ultimately dismantle India's fintech sector within the startup domain. However, other netizens were quick to contradict. While innovation is crucial, it shouldn't involve disregarding laws and regulations to pursue business expansion.

A Case Study: Conclusion

Paytm's decline in the stock market has sent ripples across the industry, with investors and analysts closely watching the company's next move. Despite the current challenges, Paytm remains a major player in the mobile payments space in India, with millions of users relying on its services for their day-to-day transactions. It remains to be seen how the company will navigate this latest challenge and continue to provide value to its users and investors alike.

- By

Shreya Singh, Member, The Commerce Society

References -